Affordable Healthcare Financing: Revolutionizing Clinics in Underserved Regions

As the demand for accessible healthcare rises, especially in underserved regions across India and globally, low-interest medical equipment loans have emerged as a game-changer. These financial solutions empower healthcare professionals to establish diagnostic services and medical facilities efficiently. Here’s a comprehensive look into how these loans are simplifying healthcare financing in 2025 and driving industry growth.

Why Medical Equipment Loans Are Crucial for Healthcare Growth

Meeting Rising Healthcare Demands

Healthcare awareness has significantly increased post-pandemic, leading to higher demand for diagnostic services and advanced medical facilities. However, many healthcare professionals face funding challenges, which hinder their ability to acquire state-of-the-art equipment and expand services. Low-interest medical equipment loans bridge this gap by providing affordable financing solutions, allowing clinics to scale operations seamlessly.

Supporting New and Existing Clinics

Whether it’s setting up a new clinic or upgrading an existing one, medical equipment loans enable professionals to:

- Purchase cutting-edge diagnostic tools.

- Expand infrastructure with modern medical devices.

- Stay competitive by offering advanced treatment options.

Simplifying Healthcare Financing for Professionals

Flexible Loan Options Tailored for Healthcare Professionals

Low-interest medical equipment loans come with:

- Attractive interest rates starting at 8.95%.

- Flexible repayment tenures of up to 15 years.

- Minimal documentation for hassle-free processing.

These features ensure doctors, clinic owners, and healthcare entrepreneurs can focus on delivering quality care without financial stress.

Accessible Financing for All Needs

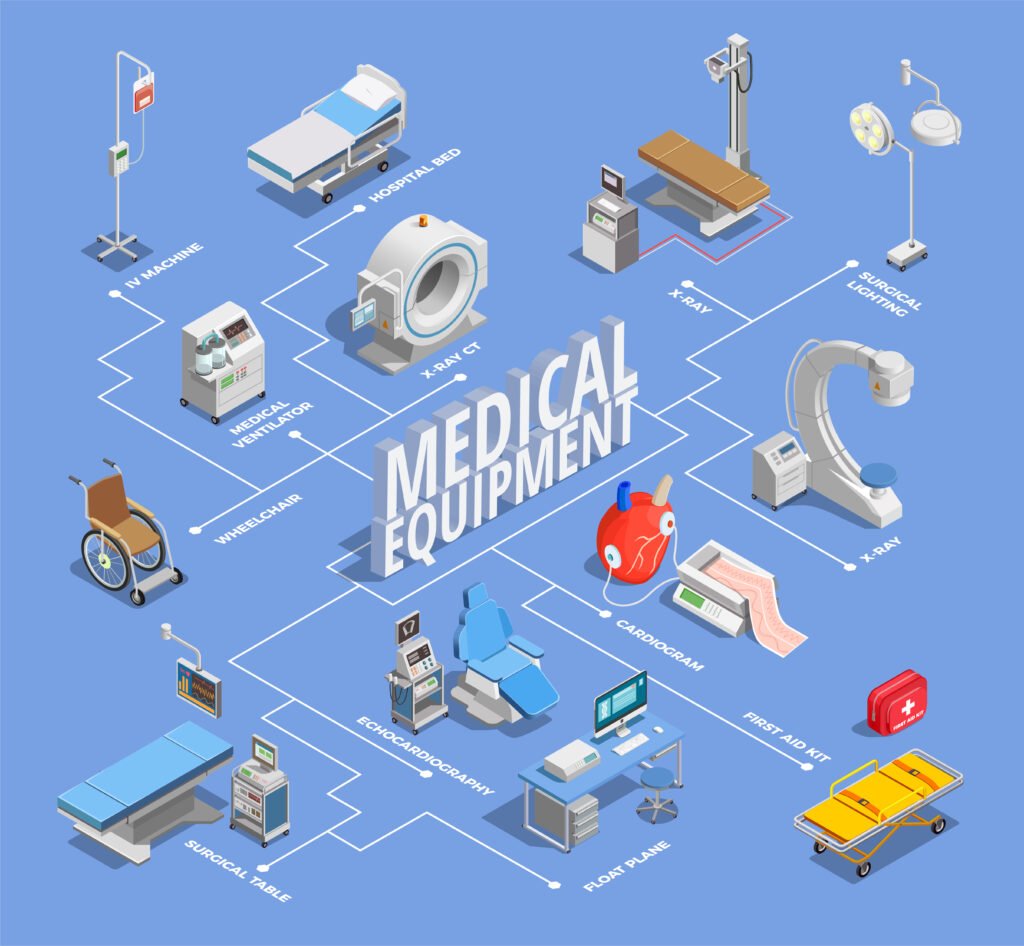

From small diagnostic centers to large hospitals, these loans cater to varied requirements, including:

- Diagnostic imaging equipment like MRIs and CT scanners.

- Laboratory tools for pathology and clinical testing.

- Patient care systems, including ventilators and monitors.

Key Benefits of Low-Interest Medical Equipment Loans

Improved Access in Underserved Areas

Bringing modern healthcare facilities to remote regions has always been a challenge. With affordable financing options, professionals can overcome budget constraints, ensuring advanced medical services reach underserved populations.

Enhanced ROI for Healthcare Entrepreneurs

Investing in high-quality equipment through affordable loans results in better patient outcomes, increased patient satisfaction, and higher revenues, ensuring a solid return on investment (ROI).

Government Initiatives and Subsidies

Many loan providers collaborate with government programs to offer additional benefits such as:

- Subsidized rates for rural or underdeveloped areas.

- Tax benefits for investments in healthcare infrastructure.

How to Secure Low-Interest Medical Equipment Loans in 2025

Choose the Right Lender

Compare lenders based on their interest rates, tenure flexibility, and additional benefits. Leading institutions like Riverview Finserve specialize in healthcare funding with competitive rates and personalized support.

Prepare Essential Documents

Simplify your loan application process by keeping the following ready:

- Business proof (clinic or hospital registration).

- Financial statements for existing facilities.

- Equipment quotations or invoices.

Evaluate Your Repayment Capacity

Opt for loans with repayment terms aligned with your clinic’s revenue cycle to ensure sustainable growth without overburdening finances.

Real-Life Success Stories

Dr. Mehta’s Multispecialty Clinic

Dr. Mehta, a clinic owner in a tier-2 city, secured a low-interest loan to purchase advanced diagnostic equipment. This not only increased the clinic’s capacity but also attracted more patients seeking reliable healthcare services locally. The result? A 30% growth in revenue within a year.

A Diagnostic Startup in Rural India

A group of young healthcare entrepreneurs utilized affordable financing to set up a diagnostic center in a rural area. With government subsidies and low-interest loans, they successfully offered essential diagnostic services at minimal costs, addressing a long-standing healthcare gap.

The Future of Healthcare Financing

Expanding Diagnostic Services Globally

As global healthcare awareness grows, the role of financing in empowering clinics cannot be overstated. Low-interest medical equipment loans are paving the way for sustainable growth, innovation, and expanded reach in healthcare.

Empowering Professionals for Long-Term Impact

With competitive financing options, healthcare professionals can focus on improving patient outcomes while achieving financial stability.

Conclusion

Low-interest medical equipment loans are more than just a financial tool; they are a catalyst for transforming the healthcare landscape in underserved regions. By simplifying healthcare financing, these loans empower clinics to offer advanced diagnostic services, improve patient care, and achieve sustainable growth. In 2025, they remain instrumental in building a healthier future for all.