Steps to Start a Manufacturing Business in India: A Guide to Machinery Loans and Project Funding

Starting a manufacturing business in India is a lucrative opportunity, but it requires careful planning, substantial investment, and a solid financial strategy. From securing machinery loans to managing working capital, navigating the financial landscape can be challenging. Here’s a step-by-step guide to help you establish your manufacturing unit successfully with customized funding solutions from Riverview Finserve.

1. Identify Your Business Idea and Conduct Market Research

Start by identifying a profitable manufacturing idea based on market demand and resource availability. Conduct thorough research to assess customer needs, competition, and growth potential.

How Riverview Finserve Helps: Riverview Finserve provides financial advisory services to evaluate market viability and financial feasibility before you invest.

2. Register Your Business and Obtain Licenses

Choose the right business structure—sole proprietorship, partnership, LLP, or private limited company—and complete the registration process with the Ministry of Corporate Affairs (MCA). Obtain necessary licenses such as GST registration and factory licenses.

How Riverview Finserve Helps: Riverview Finserve assists in securing funds to cover registration costs and regulatory compliance expenses.

3. Select an Ideal Location and Infrastructure

Identify a location that ensures smooth logistics, raw material supply, and labor availability. Ensure the site meets regulatory guidelines and operational efficiency.

How Riverview Finserve Helps: Riverview Finserve offers project funding solutions to help businesses acquire land and develop necessary infrastructure.

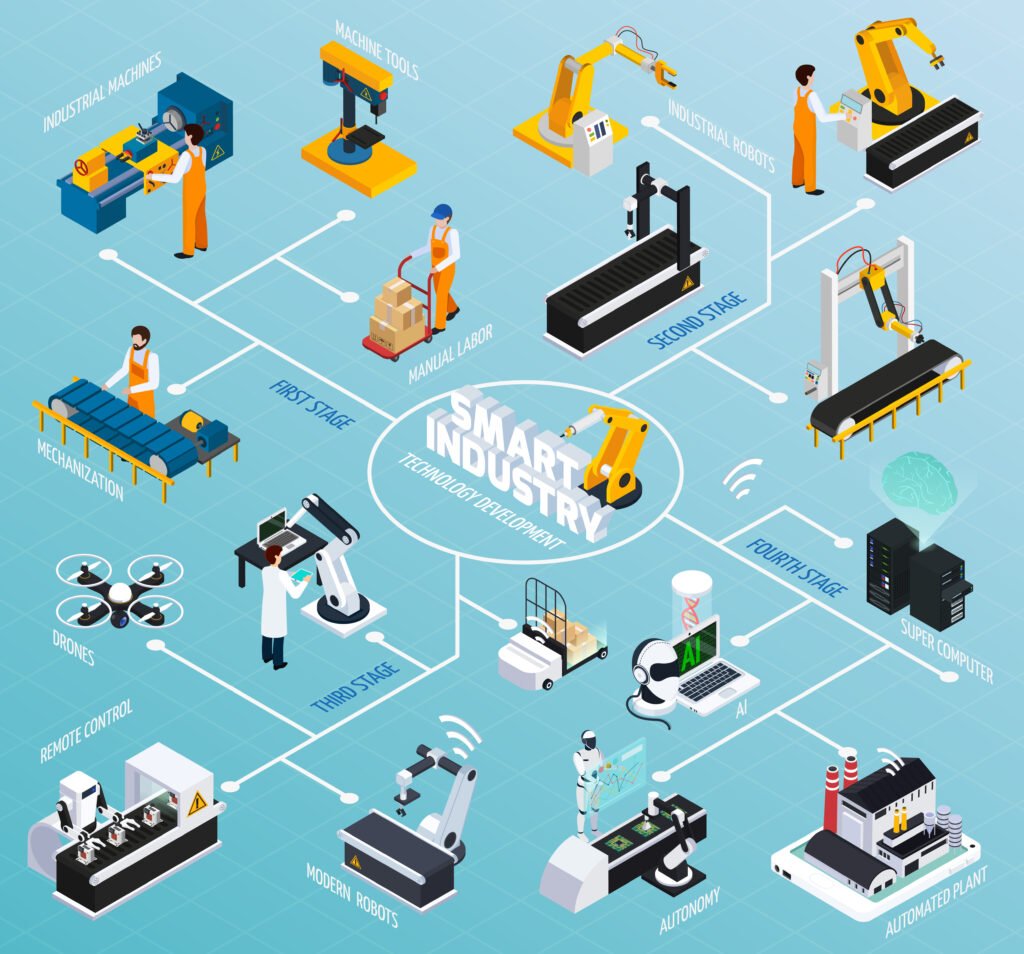

4. Arrange for Machinery and Equipment

Investing in the right machinery enhances production efficiency. Acquire machinery through outright purchase, leasing, or loans. Explore government schemes offering machinery loans at competitive rates.

How Riverview Finserve Helps: Riverview Finserve offers tailored machinery loans with flexible repayment options to facilitate the acquisition of state-of-the-art equipment.

5. Secure Machinery Loans and Project Funding

Funding is crucial for acquiring machinery and setting up your manufacturing unit. Banks and NBFCs provide machinery loans and project funding. Consider government-backed schemes like CGTMSE, PMEGP, and MSME loans.

How Riverview Finserve Helps: Riverview Finserve specializes in securing machinery loans and project funding with customized financial solutions.

6. Obtain Working Capital Financing

Manufacturing businesses need ample working capital to manage daily operations, raw material procurement, and labor costs. Explore working capital loans, overdraft facilities, and invoice discounting solutions.

How Riverview Finserve Helps: Riverview Finserve provides working capital solutions such as cash credit, overdraft facilities, and invoice discounting for smooth business operations.

7. Hire Skilled Workforce and Ensure Compliance

Recruit skilled labor and ensure compliance with labor laws, employee insurance, and safety norms. Training staff enhances operational efficiency.

How Riverview Finserve Helps: Riverview Finserve offers payroll financing and funding for employee training programs.

8. Develop a Robust Supply Chain and Distribution Network

Establish a reliable supply chain for raw material procurement and streamline the distribution network. Partner with logistics providers to ensure seamless operations.

How Riverview Finserve Helps: Riverview Finserve offers trade finance and supply chain financing solutions.

9. Implement Marketing and Branding Strategies

Create a strong brand presence through digital marketing, promotions, and strategic partnerships. Leverage social media and e-commerce platforms to expand market reach.

How Riverview Finserve Helps: Riverview Finserve provides marketing finance solutions to support advertising and branding campaigns.

10. Monitor Performance and Scale Your Business

Track key performance indicators (KPIs) and financial metrics to identify growth opportunities. Consider expanding by scaling production and diversifying your product lines.

How Riverview Finserve Helps: Riverview Finserve offers expansion funding, business loans, and financial consulting to help manufacturers grow effectively.

Conclusion

Starting a manufacturing business in India requires strategic planning and efficient financial management. Securing machinery loans, project funding, and working capital solutions can ensure smooth business growth. Riverview Finserve is your trusted partner, providing tailored financial solutions to help your manufacturing venture succeed.

Need expert assistance for your manufacturing business? Contact Riverview Finserve today for customized funding solutions!